[Disclaimer: SPARK Business Works is not a certified tax professional. Tax law is complicated and changes frequently. Do not invest in software development with the intention of receiving tax benefits without first consulting with a qualified tax professional about your individual business.]

When companies hire us to build custom software, they’re looking for solutions that fit the exact needs of their business. Software that will streamline their operations. Software that will give them a competitive advantage.

What they don’t anticipate is the tax benefits of building and buying software.

While no one develops software just for them, they’re like icing on the cake for your organization and financial goals.

Keep reading to understand the process of capitalization and expensing when building custom software. You can discuss these types of decisions with a qualified tax professional to see what the best strategy is for your business.

-1.png)

The Benefits of Capitalizing or Expensing Software Development Costs

Software development costs affect taxes mainly by their classification as either current expenses or capitalized assets.

- Are the development costs classified as expenses that reduce the income of the current fiscal year?

- Are they classified as an asset that is added to the balance sheet and its value realized over time?

Depending upon its situation, one company might prefer to treat all software development costs as expenses so it can reduce its profits and thus lower its tax bill at the end of the year. But a different company might want to maximize the assets on its balance sheet and capitalize all development costs.

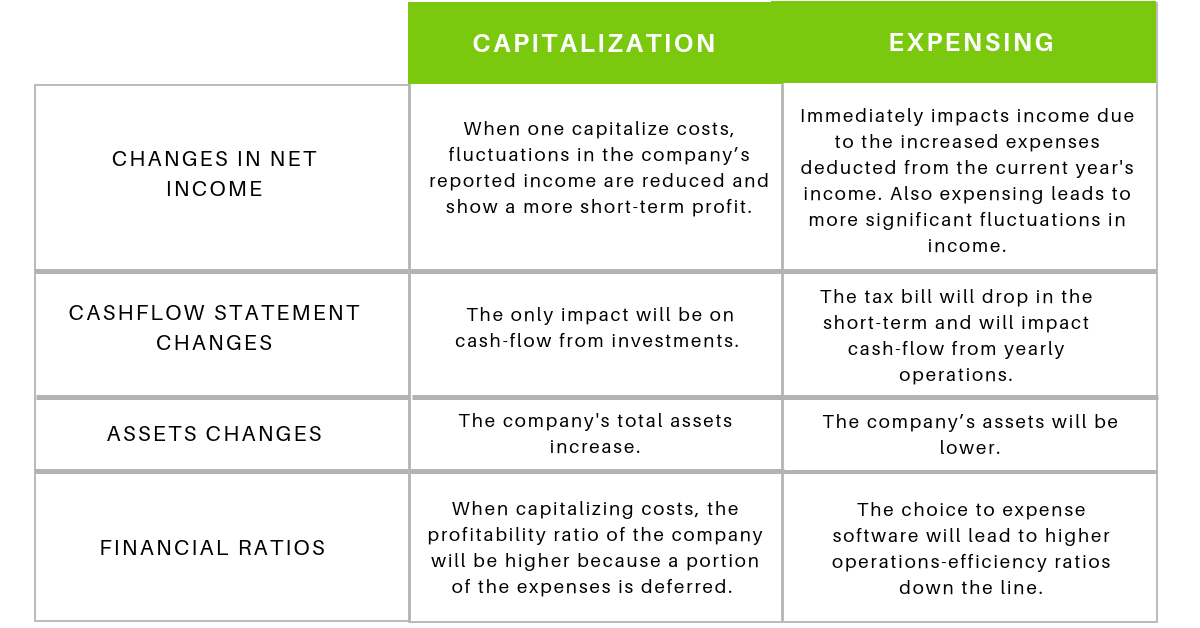

Outcomes of Capitalization and Expensing Compared

Businesses can have a lot of flexibility as to whether they classify development costs as a current year expense or a capitalized asset.

Whether to expense or capitalize depends on your business. Some organizations might want to reduce taxable income for the year for various reasons. While others are maybe owned by private equity or VC (venture capital) or they’re trying to maximize Earnings Before Interest, Taxes, and Amortization (EBITA). If you’re sitting on cash, you may pay for software upfront. In other cases, you’re managing it to an EBITDA number and you can spread it out and capitalize.

Depending on what you’re experiencing, you can refer to Generally Accepted Accounting Principles (GAAP) to understand what you can expense versus capitalize.

What is GAAP?

GAAP is designed to produce consistency in financial statements.

Using GAAP principles allows investors and outside parties (like lenders) to easily understand an organization’s financials and meaningfully compare them with the financials of other organizations. If a business is publicly traded, it must use GAAP.

GAAP provides guidelines that help businesses decide which software development expenses should be capitalized and which should be expensed.

According to John Orlando, CFO, Centage Corporation, “Based on GAAP, software can be capitalized if it is purchased to serve the internal needs of the company. Typically, it encompasses a perpetual software license that is purchased one time and can be used indefinitely.” Software that falls into this category includes custom management, operations, or production systems that benefit internal operations of a company.

While we will be discussing some GAAP principles here, be aware that there are some differences between GAAP and how the Internal Revenue Service requires companies to report income and expenses. These differences are beyond the scope of this article.

An Example of Capitalizing and Expensing Software Costs

Here’s an example to show you how the classification of software development costs as expenses or assets affects a company’s financials.

Let’s say that a construction company spends $200,000 on the development of a new piece of software. The software is expected to streamline operations and increase income.

Classifying the full $200,000 as a current year expense would not accurately represent the investment’s effect on the company’s finances. This is because the software will provide value for multiple years and not in the year in which it was developed.

So, it makes sense that at least some of the $200,000 should be capitalized and added to the balance sheet as an asset.

But how much? GAAP has rules that provide guidance.

Here, the finance team applies GAAP rules and decides that 60% of the development costs were spent in coding and development, which is a capitalizable asset under GAAP.

60% of $200,000 is $120,000. So, $120,000 will be added to the balance sheet as an asset and will be amortized over a 5-year period according to GAAP rules.

The remaining 40%, $80,000, is classified as a current year expense and will reduce the year’s profit and its tax liability.

When to Capitalize Versus Expense

Typically, financial teams who are deciding to capitalize or expense costs divide assets into two groups:

- Assets that DO produce value at a later date

- Assets that DO NOT produce value at a later date

In the example above, a portion of the $200,000 development cost is added to the balance sheet as an asset because it will provide value to the company at a later date.

Deciding whether to capitalize or expense development costs can be a challenge. But GAAP provides guidance as to what costs should be capitalized and what should be expensed.

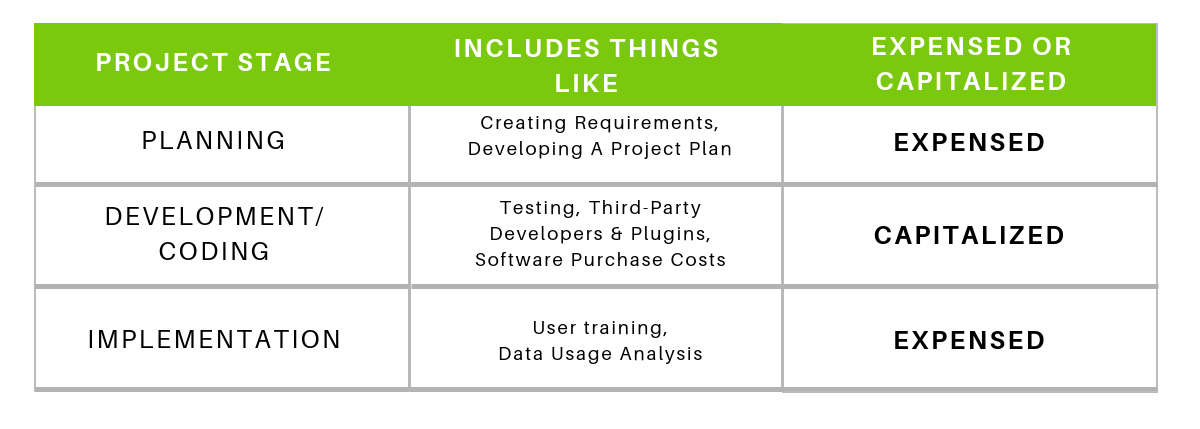

In fact, much of the flexibility that businesses have in classifying costs as expenses or assets comes down to how they choose to characterize the phase of development the software is in when a certain cost is incurred (for example, “feasibility phase,” “development,” or “coding”).

According to The Journal Of Accountancy, there are various types of software development processes covered under GAAP. The most common software development model outlined in GAAP is referred to as the “waterfall approach.” This term means there are sequential steps that software development follows. And depending on what step a cost was incurred, that will determine if it is expensed or capitalized.

However, there are different sets of rules for software that is developed for internal use and software that is developed for external use (that is, software that is developed to be sold).

Software for Internal Use

Internal-use software will never be sold and is developed for a company’s internal operations.

Examples of software for internal use include

- CRM Tools

- Accounting Systems

- Project Management Tools

- Internal Data Tools

GAAP has specific rules to categorize costs incurred during the development of internal-use software.

Depending on the product’s stage of development when the costs were incurred, they will be expensed or capitalized.

Generally, under GAAP, costs for purchasing internal-use software should be capitalized.

Software for External Use

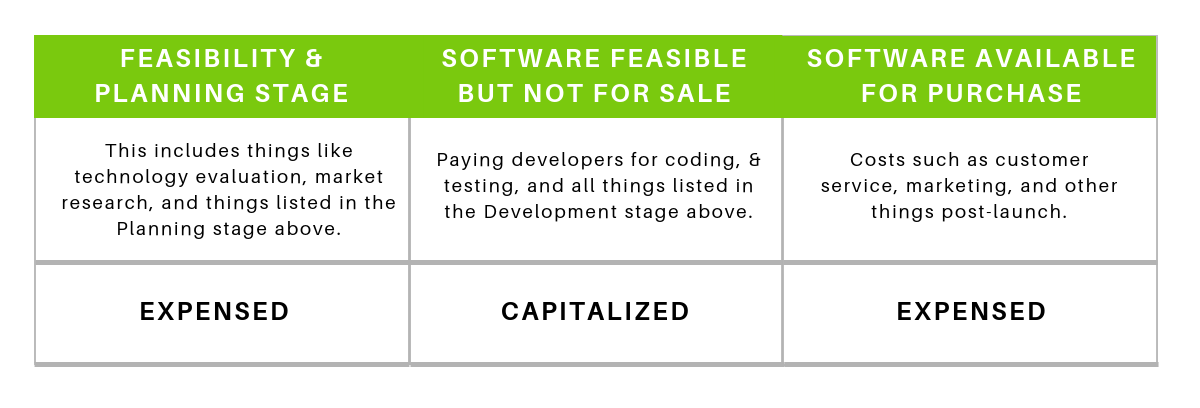

External-use software is any software that is developed with the intent to be sold to external users or customers. Examples of external-use software include Software as a Service (SaaS) products and apps available for purchase in the App Store.

As is the case for internal-use software, whether a cost should be expensed or capitalized depends on the product’s stage of development when the costs were incurred.

But the rules for external use software development cost classification are different from those of internal-use software development costs. See below.

Realizing Your Tax Benefits

The tax benefits can be an unexpected advantage of investing in custom software. Understanding when and how to capitalize or expense your software can help you better manage the financial health of your business.

Remember that tax law is complicated and changes over time. Nothing in this article is intended to be legal or tax advice. Before you invest in software development with the intention of gaining tax advantages, be sure to talk with your tax professional about your individual business.

Want to develop custom software? Check out our go-to guide to learn how the development process works and how to be successful with your own product.